Build a strong foundation with new clients, or clients new to FreshBooks, by developing a stellar onboarding process.

Client onboarding is a big deal. Once you’ve landed a client who’s an excellent fit for your firm, onboarding is their first impression of how it will be to work with you and the first step in (hopefully) a long and lucrative relationship for everyone involved.

To help you start off on the right foot, we’ve outlined a client onboarding process you can use for the business owner clients you’re setting up in FreshBooks for the first time or for clients you’re introducing to the Collaborative Accounting™ framework.

If you aren’t familiar with the term, Collaborative Accounting™ is the methodology we recommend using with your client year-round so you can both get the most out of FreshBooks. But it’s not a requirement for onboarding your client in FreshBooks. The guidelines and resources are flexible, so they work for clients with different needs and can be tailored to your firm’s process. Let’s go!

Table of Contents

But First, Are You FreshBooks-Certified?

Before jumping into onboarding, make sure you’ve got all the tools you need to support your clients in FreshBooks. The FreshBooks certification gives you the foundation you need to help your clients navigate the software and establish collaborative workflows with them. Once you complete it, you’ll be a member of the FreshBooks Accounting Partner Program.

In the certification, you’ll find guidance on how to break down roles and how to coach clients on tasks within the framework, including:

- Recommendations of what your client should take on in FreshBooks

- Benefits to the business owner of handling this task

- Training guidelines for each task

- How-to videos for each task

- Detailed workflows and scenarios for each task

- Practical case studies

- Downloadable resources for your clients

The certification is free, takes just 4 hours or less to complete, and is entirely online and self-directed, so you can do it anytime. Plus, it includes hands-on training and downloadable resources to use for onboarding and beyond.

After completing the certification, bookkeeper and advisor Kristen Nies Ciraldo of The Friday Guide told us: “This is the best certification course I’ve ever seen in the accounting space. [It] actually provided a philosophy rather than just ‘[this] is how you use the platform’.”

Once you complete the certification, you’ll have access to dedicated support for FreshBooks Accounting Partners, too. There’s no better place to start!

What to Cover in the Onboarding Meeting

Whether you’re holding a first meeting with new clients or an introduction to the FreshBooks accounting software with existing clients, the onboarding meeting is your opportunity to introduce your clients to how the collaborative relationship will work, set expectations, and discuss roles and responsibilities.

The goal? You and your client both leave the onboarding meeting clear on what you need to do, when you need to do it, how and when you will communicate and check in with each other and why the process and workflow you’re using together are important to help them meet their business goals.

Following are some key points to cover in this meeting.

1. Identify Business Goals

“Why” is always a great place to start. Talk about the business goals your client is aiming for to develop key performance indicators (KPIs) that’ll keep tabs on their progress. Understanding their goals will also help you determine what they need from the FreshBooks software and from you as an accounting partner.

2. Introduce the Collaborative Accounting™ Workflow

A collaborative workflow could be pretty different from what your client is used to, and you’ll probably need to walk your client through it to get them on board, both mentally and logistically. And you can start small: Collaborative Accounting isn’t all or nothing. Try adopting a few elements of the collaborative workflow and customize it to suit both your needs and those of your client.

Use the onboarding meeting to talk about the benefits of Collaborative Accounting and getting more hands-on with their business financials. Explain how being involved and educated in the process—and paying you for advisory-level guidance instead of paperwork—can empower them and give them the insights they need to grow.

Shared Accountant-Client Workflows: A Case Study

Worried about handing the reins of certain tasks over to your clients? FreshBooks was literally built for this! FreshBooks customer and communications coach Alexis Carreiro told us she was “completely overwhelmed” by other software. She said, “I wanted something far more user-friendly, and that’s why I chose FreshBooks. It wasn’t intimidating, and I could see myself using it.” Her accountant, Rebecca Kittel, can access her FreshBooks account and step in where needed.

Rebecca sees the benefits for Alexis, too: “Business owners who are more involved with their accounting systems have a better understanding of their finances and their cash flow.” They make better decisions based on the real-time financial information they see in their account.

Alexis agrees: “I’m far more confident making financial decisions for my business now that I’m using FreshBooks and have Rebecca as my financial partner.”

The Collaborative Accounting Framework

If you’re a FreshBooks-certified Accounting Partner, download the detailed Collaborative Accounting™ framework provided in the FreshBooks Client Onboarding Pack to share with your client. This will serve as a teaching tool and a starting point to explain who is responsible for what throughout the accounting cycle.

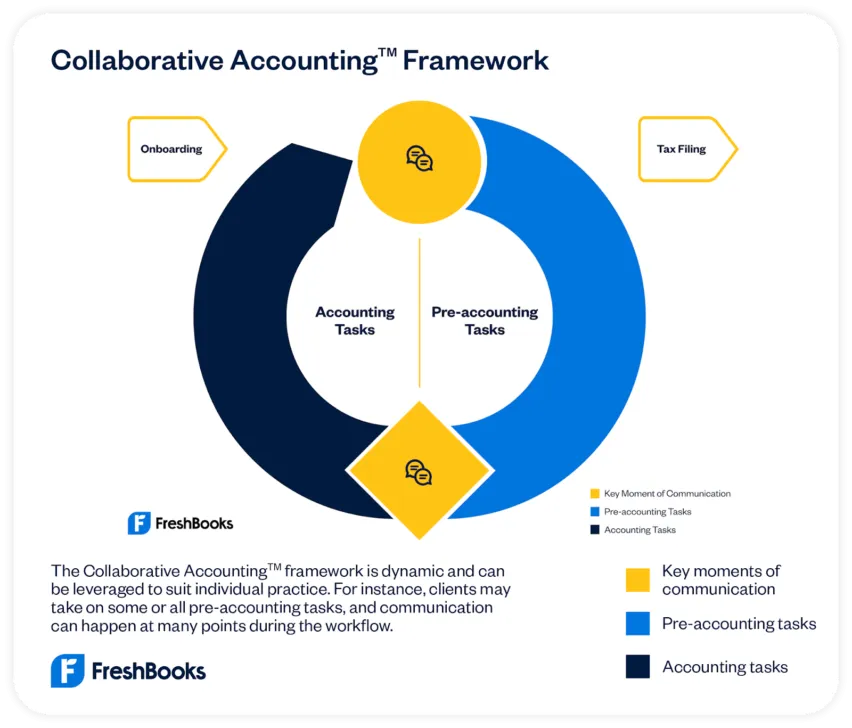

In the Collaborative Accounting framework, your client handles some (or all) of their day-to-day pre-accounting tasks in FreshBooks. How much or how little depends on each unique business owner. For example, they may create and send estimates and invoices, track time and pay people, chase payments, upload receipts, and track expenses. You, in turn, focus on more complex accounting tasks like bank reconciliation, journal entries, generating reports, and interpreting financial data.

This benefits you and your client. FreshBooks Accounting Partner Kenji Kuromoto agrees: “In many cases, it’s more efficient for the client to be doing these things. How does it make sense for a client to be sending us a big spreadsheet and saying, ‘Here’s everybody’s time. Can you enter it in FreshBooks for us?’ Well, what if you just entered the time yourself and generated the invoices? You’re actually being more efficient, more effective. You’re keeping the spending and the accounting function down, too.”

3. Establish Your Process

Once you get a sense of your client’s goals and you’ve discussed the benefits of a collaborative relationship, you can start to talk about how you’ll work together. Getting on the same page about who owns which tasks helps ensure that you get the data you need.

Here’s what to establish with them:

- Who will take on which responsibilities

- How and when to complete the handover document (FreshBooks-certified Partners can download this from the certification)

- How you’ll share financial insights (the meeting agenda template in the certification is a great starting point)

- How regularly you’ll meet (monthly? quarterly?) and in what format (video chat? in person?)

Here’s how it might work: Your client carries out their tasks (e.g. invoicing monthly) and completes the handover document each quarter. Once you receive it from them, you do your quarter-end review, gain insights, and fill out your meeting agenda template ahead of the client meeting.

4. Review Their Tech Stack

Take a look at the apps and tools the business uses now, and ask your client how comfortable they are with each one. Use your knowledge of their business goals to demonstrate your expertise and advise them on how they can work more efficiently.

You may be able to recommend they streamline their tech stack and bring some workflows inside the FreshBooks platform. For example, you might suggest they send their proposals directly from FreshBooks, so they can be automatically converted to Projects or invoices to send to their customers.

5. Create Expense Categories

Keeping tabs on expenses is a common stumbling point for many business owners, leading to bad data, inaccurate reports, and tax compliance headaches. That’s why it’s important to talk about the importance of expense tracking from the start, establish your approach to categorization, and provide your client with helpful tools.

Share a sample list of expense categories they can use and show them how to apply an Ask My Accountant category for anything they’re unsure about. You may not pin down all expense categories in your initial onboarding meeting, but you can touch on them again at your next client meeting. Especially if clients are taking on expense management themselves, it pays to invest time in educating your client so you can avoid expense chaos at year-end!

6. Identify the Best FreshBooks Plan

Once you’re clear on how your client’s business operates, what they need, and what their aspirations are, you can match them to a FreshBooks plan that has the right features and functionality for them. You’ll want to get them on either a Plus, Premium, or Select plan since all 3 have a dedicated (free) Accountant Role that allows you direct access to the chart of accounts, reports, and other features you need.

Discuss with your client whether you or they will handle paying for the account, along with the next steps. If they handle payment, then they will set up the account and invite you to the Accountant role. If you are bundling the cost of their software into your fees, you can set up their account so they’re ready to go and then invite them from your Accountant Hub.

Next Step: Set Up the Client Account in FreshBooks

The final step in onboarding your client to FreshBooks is setting up and customizing their account in the software itself. The best way to do this is via your Accountant Hub dashboard. (Don’t have access to that? Wondering what it is? Read more about the Accountant Hub.)

From the Accountant Hub, you can create and access their FreshBooks account in order to set up the following:

- Chart of accounts

- Payment gateways

- Connected apps

- Expense categories (optional)

Now, you can invite the client to their new account.

If your client is already a FreshBooks user, we can help you connect their account to your dashboard. Just reach out to a partner consultant at accountants@freshbooks.com.

Keep It Going: Streamline Client Onboarding

Onboarding isn’t a one-and-done thing. You’ll want to make sure it’s sustainable for the long haul. That means having a system in place. Just because every client is different doesn’t mean every client needs a different onboarding process. Some standardization will save you valuable time with onboarding and allow you to get up and running with a new client immediately.

To do this, it helps to identify clients by type and start there. Nayo Carter-Gray, CEO of 1st Step Accounting, says, “When I decided the type of clientele we were going to serve…I was able to create a template of emails, data requests, and tutorials.”

This might sound daunting, but it can be as simple as:

- Creating some communication templates

- Organizing the materials you plan to share with your clients

- Storing them in a central location

- Customizing the Collaborative Accounting™ framework diagram to suit your niche and onboarding approach

Training, Education, and Resources

After completing the 4-hour FreshBooks Collaborative Accounting certification, you’ll get access to all the resources mentioned here to share with your team and your clients.

Here’s what’s included in the Client Onboarding Pack:

- Full Collaborative Accounting™ framework diagram

- Workflow checklists for:

- Data

- Estimates and Proposals

- Expenses and Bills

- Invoices and Payments

- Projects

- Time Tracking

- Handover document checklist

- Meeting agenda template

Stay Connected: Post-Onboarding Pro Tips

Onboarding your client to FreshBooks is just the start of your journey together. Keep building on the excellent customer experience you provided in onboarding to deepen your client relationships. Some ways to do this include:

- Regularly review your client’s usage of FreshBooks for things like invoices, payments, and expenses to make sure they’re on track

- Get a sense of their level of comfort and engagement

- Collect feedback for continuous improvement

- Adjust strategies based on your client’s progress and needs

As a FreshBooks Accounting Partner, you’ll have access to all the materials mentioned here, along with accountant-specific support for onboarding beyond as you grow your advisory practice. Plus, it’s free to join. Learn more.

Written by Laura Crean, Partner Program & Education Manager, FreshBooks

Posted on January 5, 2024

What Is the Best FreshBooks Plan for Your Client?

What Is the Best FreshBooks Plan for Your Client? The FreshBooks Accountant Hub Is an Easy Way to Manage Clients

The FreshBooks Accountant Hub Is an Easy Way to Manage Clients How to Build a Better Workflow With Your Clients in FreshBooks

How to Build a Better Workflow With Your Clients in FreshBooks

![How to Sustainably Grow Your Accounting Firm [Free eBook] cover image](https://prod-blog-k8s.freshenv.com/blog/wp-content/uploads/2023/02/eBook-Blog-Hero-Image_APP_Sustainably_Grow-226x150.png)