The VAT Reverse Charge is a fairly new function in the U.K. construction industry aimed at putting an end to VAT fraud.

The VAT domestic reverse charge for building and construction services was introduced on 1 March 2021. This came after a couple of delays caused by Brexit and the Covid-19 pandemic to give companies more time to prepare for the changes involved.

HMRC says it introduced the measure to tackle fraud in the construction sector, where businesses could charge VAT for their services and then vanish without paying their VAT bill. They could take an extra 5% or 20% profit that doesn’t belong to them. HMRC’s goal is to make this kind of fraud impossible by moving the VAT charge down the supply chain.

In this article, we’ll answer the most pressing and common questions about the VAT domestic reverse charge. This includes what it is, who’s responsible for paying it, and how it should appear on a normal VAT invoice.

Table of Contents

What is the Construction Industry Scheme VAT Reverse Charge?

The VAT domestic reverse charge for building and construction services is an extension of the Construction Industry Scheme (CIS). It applies to business transactions under the CIS, and between VAT-registered businesses, contractors, and sub-contractors.

Under the charge, a business supplying construction services to a VAT-registered customer isn’t accountable for the VAT. Instead, the customer is accountable.

Sub-contractors will require the contractor employing them to be responsible for paying VAT directly to HMRC. The payment received covers the cost of the work and materials used, net of any CIS deductions for tax and National Insurance. No VAT will be paid on the invoice.

The charge reflects a change in how VAT is handled for some UK construction services, plus the building and construction materials used in providing these services. It doesn’t apply to materials supplied separately from any construction services.

How Do You Calculate the VAT Reverse Charge?

As a construction business, you charge the customer for the taxable value of your services and labour as normal, and work out the reverse VAT by multiplying the cost of your services and labour by the VAT rate of 20%. You should add the VAT value to your customer’s sales and purchases sections on their invoice.

You must show there’s a reverse charge mechanism on the invoice, and make this clear to your customer. The best thing to do is issue a normal VAT invoice, and include the VAT registration details for you and your customer.

Who Pays the VAT Reverse Charge?

The charge applies to services between most construction businesses, contractors, and sub-contractors in the U.K. If your CIS business receives construction services and gets an invoice with the reverse charge applied, you pay VAT as part of your overall input tax. It’s as if you’ve charged it yourself.

If you don’t have a VAT-registered business, the reverse charge can’t be applied to you. In this case, normal VAT rules apply to the supplier. They’ll charge you the VAT and account for it as usual.

If you aren’t VAT registered, be sure to make this clear to your supplier.

The reverse charge also doesn’t count towards a company’s potential VAT threshold. So, if you’re not registered for VAT, applying the reverse charge won’t push you over the limit.

The reverse charge doesn’t apply to end users, either. This includes people using a building that’s been constructed using the services provided, such as landlords and tenants.

HMRC says the VAT reverse charge doesn’t apply to sub-contractors unless they answer yes to all of these questions:

· Are your supplies within the CIS scope?

· Is the supply a standard or reduced rate?

· Is your customer VAT registered?

· Will your payment be reported under CIS?

· Is the customer not an end-user?

VAT Reverse Charge Example

Let’s say you complete building work for a client worth £5000. The client you work for is registered for VAT, so you don’t add VAT to the invoice you send them. You’ll show the VAT, worth £1000, on the invoice as being reversed. You don’t record this on your VAT return, but you do make a note of the net value of the sales (£5000) in the net sales box (6).

The client records your invoice for the purchase of the building work. The VAT isn’t charged on the invoice, but they report the £1000 VAT and apply the reverse charge rules. They then report this on their VAT return in box 1 (sales) and box 4 (purchases).

Does the VAT Reverse Charge Apply to Goods?

The reverse charge applies to construction services that are subject to standard and reduced rates of VAT. It also applies to goods supplied with those services. If your supply contains a mix of specified and other construction services, it’s considered a single supply of specified services. The domestic reverse charge will apply in this situation.

Does the VAT Reverse Charge Apply to Labour and Materials?

The charge affects supplies of building and construction services at the standard and reduced rate of VAT. These need to be reported under CIS. HMRC defines these as ‘specified supplies’. However, there’s a key difference between CIS and the reverse charge when it comes to materials. The reverse charge applies to the whole invoice, including services and materials.

If any of the services need to be reverse charged, all other services will be subject to this as well.

If you’re not sure whether a type of work falls under the definition of a specified service, the reverse charge should apply so long as your customers are VAT-registered businesses and their payments are subject to CIS.

What is the Difference Between CIS and Domestic VAT Reverse Charge?

There’s a key difference between CIS and the domestic reverse charge when materials are involved as part of the building and construction services. The reverse charge applies to the whole service, and you appoint CIS payments to net status sub-contractors. You apply no deductions to the materials in this case.

What Box Does the VAT Reverse Charge Go In?

On your VAT return, enter the output tax on purchases where the domestic reverse charge applies in box 1. You can reclaim the input tax on your reverse charge purchases in box 4 of the VAT return under the normal rules. You’ll need to make the necessary entries in boxes 6 and 7, as you normally would.

You’ll also include sales invoices with VAT reverse charge figures in box 6. But these should be excluded from the flat rate calculation. Purchase transactions with the VAT domestic reverse charge are outside of the flat rate scheme.

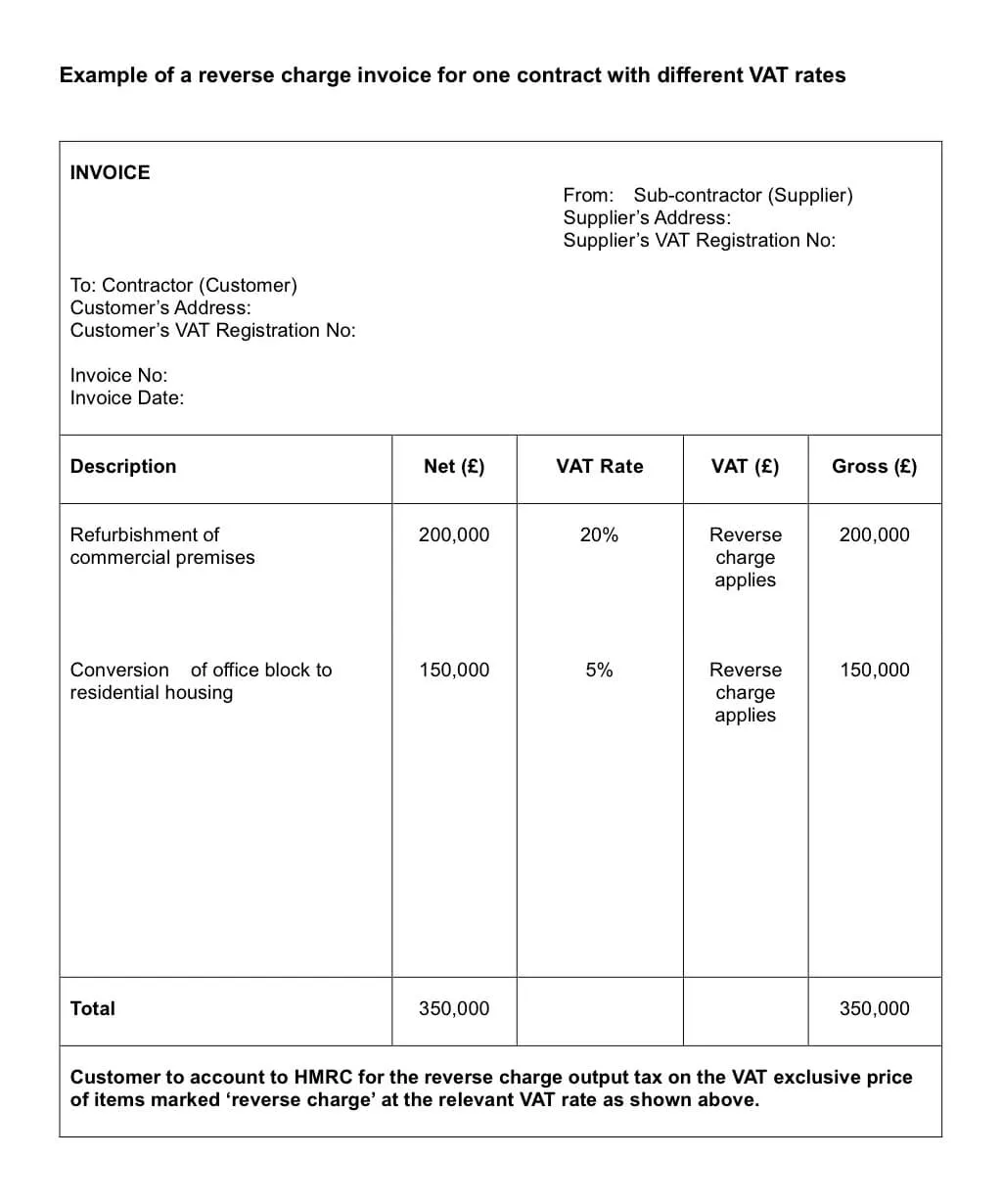

What Does a VAT Reverse Charge Invoice Look Like?

Here’s an example of a VAT reverse charge invoice:

Source: Gov.UK

VAT Reverse Charge Summary

It’s a good idea to become familiar with what is and isn’t included under the VAT domestic reverse charge. You should also talk to any contractors you regularly work with to make sure everyone understands the requirements for construction services.

If you’re a contractor, you may also want to speak with the sub-contractors you frequently work with and discuss the reverse charge with them.

You may need to review the contracts you use and mention you apply the reverse charge to your services in these. And check your accounting systems can handle reverse charge invoices.

For more advice on using the VAT domestic reverse charge, consider speaking with a VAT specialist or contacting HMRC directly to discuss VAT or the CIS.

This post was updated in December 2023.

Written by Greg Henley, Freelance Contributor

Posted on March 30, 2022

This article was verified by Levon Kokhlikyan, ACCA

How to Employ Someone in a Small Business in the U.K.

How to Employ Someone in a Small Business in the U.K. What You Need to Know About U.K. Corporation Tax

What You Need to Know About U.K. Corporation Tax 6 Taxes U.K. Small Business Owners Should Know About

6 Taxes U.K. Small Business Owners Should Know About