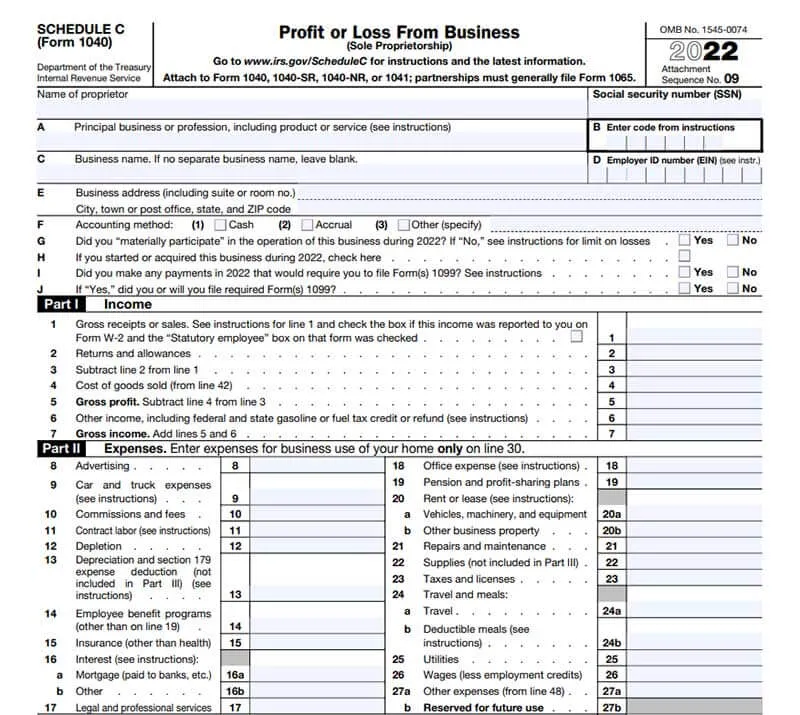

What is Schedule C—and how to fill it out.

If you’ve just started your business, or you have a business that didn’t make much money during the year, you might wonder if and how you need to report it to the IRS. The IRS wants to know everything you’ve earned (and spent) each year. For some business owners, this means using Schedule C.

Who needs to use Schedule C and how can you navigate the form? This guide will help you make sense of the rules.

What Is a Schedule C?

Schedule C is a tax form used by unincorporated sole proprietors to report their business income and expenses. It’s part of the individual tax return, IRS form 1040.

Schedule C details all of the income and expenses incurred by your business, and the resulting profit or loss is included on Schedule 1 of Form 1040. The profit or loss is also used on Schedule SE to calculate self-employment taxes owed.

Who Has to File Schedule C?

Sole proprietors and single-member limited liability companies (LLCs) need to fill out Schedule C when they prepare their individual 1040 tax return.

Not sure if you’re either of those? A sole proprietorship is a business that you own by yourself and isn’t registered as a specific business type, like a corporation or an LLC. It’s the default business structure when you earn money from self-employment without registering as a different type of business.

A single-member LLC is a limited liability company that only has one member. When you form a single-member LLC, you have the option to be treated as a corporation—and file a corporate tax return—or instead report your profit or loss on Schedule C like a sole proprietor does.

In the U.S., sole proprietors and single-member LLCs need to fill out Schedule C when they prepare their individual 1040 tax return.

Do I File a Separate Schedule C for Each Business I Own?

Yes, if you own multiple businesses, you’ll need to file a Schedule C for each one separately.

Can You File a Schedule C-EZ?

Not anymore. Schedule C-EZ was a shorter version of Schedule C that taxpayers could use if they met the following requirements:

- Your business is profitable

- Your expenses are less than $5,000

- You have no inventory

- You don’t have any employees

- You’re not using depreciation

- You’re not deducting the cost of your home

However, Schedule C-EZ was discontinued in 2019, so it’s no longer available.

Filling out Your Schedule C

Some of the forms are pretty straightforward, but there are some tricky questions that might throw you off. We’ll walk through each section and help you decide what certain lines are asking for.

Before you start you should gather:

- Your profit and loss statement and balance sheet

- Information on assets purchased during the year

- Home office and truck or car expenses

Identity Section

Line A and B: Enter a brief discussion of your business, like “website design” and input the relevant code (found in the IRS instructions for Schedule C).

Line D: Your EIN (employer identification number). If you do not have an EIN, leave Line D blank. Some people confuse their SSN (Social Security number) for their EIN—these are different identifiers, so make sure you’re using the right one.

Line F: Check off the accounting method you have used when calculating your income and expenses. If this is the first time filing your Schedule C, you can choose whichever method you prefer. If you have filed before, you have to use the same method as in previous years unless you have requested a change from the IRS. Learn about the differences between accounting methods.

Line G: Did you have an active role in your business this year? The IRS has criteria for what counts as an active role—for example, you spent at least 500 hours on business activities, or you spent at least 100 hours on business activities, which is at least as much as the other people involved in your business, or your business activities were the substantial majority of all activities for this business for the tax year, regardless of the number of hours. The IRS has a list of full criteria.

Line I: If you paid a subcontractor or another person $600 or more during the year, you’ll need to file a 1099 form. If you want to check all the situations where you might be required to file one, you can review the IRS guidelines.

Part 1: Income

Here’s where you’ll list the money that you earned during the year from your business. Some lines that might be confusing include:

Line 1: Enter the total amount of income you’ve brought in through business activities. If you received a W-2 form and the “Statutory employee” box (box 13) of that form was checked, check the box on this form as well. Otherwise, leave it unchecked.

A statutory employee is an independent contractor who is treated as an employee by having Social Security and Medicare taxes withheld. You’ll need to file 2 separate Schedule C forms if you have both self-employment income (from freelance work, for example) and statutory employee income.

Line 2: If you had any returns or allowances this year, this is where you’ll put them. A return is a refund given to customers, and an allowance is a reduction in the sales price. Most service-based businesses won’t have returns or allowances to include.

Line 4: Your total cost of goods sold. You’ll need to jump down to Part 3 to calculate this.

Line 6: Here’s where you’ll input any money that wasn’t from regular business activities (e.g., bad debts you recovered, interest, fuel tax refunds or awards you’ve won would all count here). For specifics, check out the IRS website.

Part 2: Expense

Many of the line items in the expense section are self-explanatory, and you should be able to find the amounts needed on your income statement. There are a few tricky items that need a little more explanation.

Line 9: The amount you spent on car and truck expenses. You’ll be able to claim expenses using two different methods: by using a standard mileage rate deduction or by using the actual expenses incurred (e.g., gas, parking, tires, registration, fees, etc.). Whichever method you choose, be sure to keep accurate records and receipts to support the expense.

Line 11: This is the total amount you spent on contract labor during the year—people who aren’t considered employees but performed a service for your business. Don’t include any payments here that you include elsewhere (e.g., if you hired a repair person, you could include that on Line 21, repairs, as opposed to Line 11).

Line 13: Depreciation is an annual deduction that allows you to recover the cost of property that has a life beyond a single tax year. You would enter your eligible depreciation deductions on this line. This article explains depreciation expenses.

Line 18: You’ll only include office supplies and postage on this line. For example, stamps, envelopes, paper, and printer ink would all fall into this category.

Line 24 A and B: This is where you’ll include costs for travel and meals. The IRS does have restrictions on the expenses you can take. Here’s what travel expenses are allowed.

Line 30: If you use your home for your business, you’ll need to fill out Form 8829. Whatever total you arrive at Line 36 of Form 8829 is what you want to enter on Line 30 of Schedule C.

Part 3: Cost of Goods Sold

Most service-based small businesses won’t have any dollar values to enter in this section. This is because they aren’t producing and selling a product but rather selling time and expertise.

If your business does involve selling products and you have an inventory, though, you’ll want to read the instructions listed in Part III.

Part 4: Information on Your Vehicle

If you’re claiming an expense for your car or truck, you’ll need to fill out this section. When filling out Line 44, don’t guess. You’ll want to keep a written log of your mileage to claim this expense.

Tips to Make Filling out Your Schedule C Easier

Filing out your Schedule C can feel like a lot of work to do during tax time. Here are some tips to make it feel like less of a chore:

- Keep good records throughout the year: Filling out your business income and expenses can get much easier if you keep your records accurate and updated throughout the year. Try using accounting software designed to help keep small businesses organized.

- Make quarterly estimated tax payments: Don’t wait until the end of the year to pay your taxes—you could end up being hit with penalties from the IRS. File your quarterly estimated taxes by the deadline each quarter.

- Don’t leave filing to the last minute: While taxes are due on April 18 this year for most taxpayers (or October 15 if you file an extension), don’t leave things to the last minute. You’ll not only cause yourself undue stress, but you won’t have time to consult an expert or look up any records if needed.

If you’re a sole proprietor or single-member LLC, Schedule C is an additional form you’ll need to prepare along with your 1040 tax return. While it looks long and slightly intimidating, most of the form is fairly straightforward and should be easy to fill out if you keep your records up to date.

This post was updated in October 2023.

Written by Erica Gellerman, Freelance Contributor

Posted on March 21, 2015

Accounting and Financial Jargon You Need to Know

Accounting and Financial Jargon You Need to Know Everything You Need to Know About How to Lower Self-Employment Taxes

Everything You Need to Know About How to Lower Self-Employment Taxes Your Complete Guide to Small Business Tax Credits

Your Complete Guide to Small Business Tax Credits