Accounting Partner Program

How Accounting Pro Rebecca Works Better With Clients in FreshBooks

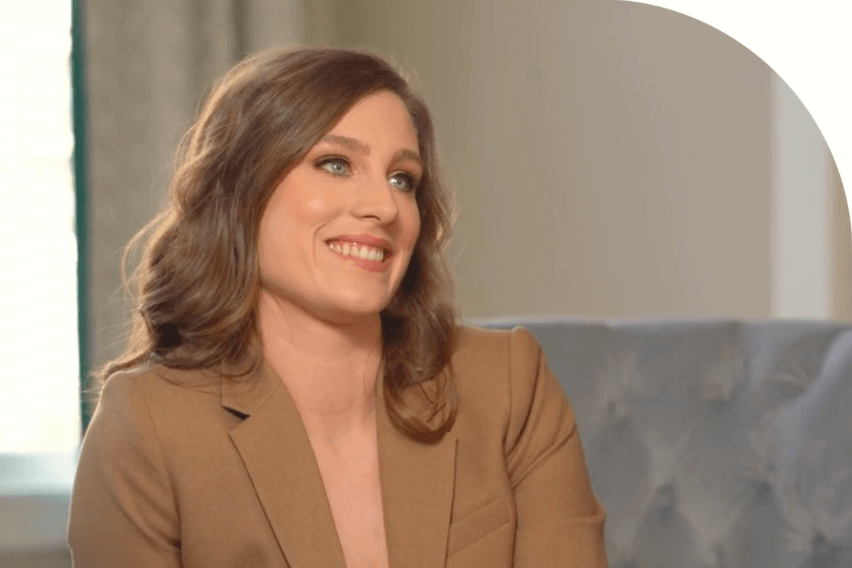

Meet Rebecca Kittel, MBA. She’s an accountant and owner of Ledger Sense, which specializes in providing virtual accounting to small businesses.

For some small business owners, it can be intimidating to work with an accounting professional. That couldn’t be further from the truth for Rebecca and her clients. As a small business owner herself, Rebecca knows firsthand the challenges of working alone.

(Read this story from her client, Alexis’s, point of view.)

Rebecca and her client, Alexis, are both small business owners, and they exemplify what a smooth accountant-client workflow looks like and how it helps them meet their shared goal: Accurately tracking and managing Alexis’s business finances.

Rebecca and Alexis have been working (and using FreshBooks) together for more than 2 years. Here’s what Rebecca had to say about how the collaborative model she follows with Alexis has impacted their relationship day to day and the value she’s able to provide her client.

What led you to start your own accounting firm?

Rebecca: I have degrees in accounting, finance, and an MBA. I worked at a Fortune 100 financial services company before I even graduated college. While I loved what I did, I started to burn out after 7 years. I thought I’d take time off to be a stay-at-home mom but quickly learned that I feel most fulfilled when I’m working, too. I started doing contract work, and once I fell into the world of small business accounting, I really found my passion. Now, I’ve been working as a small business accountant and strategic partner for 5 years, and running my business, Ledger Sense, for almost a year.

How did you get started with FreshBooks?

Rebecca: The short answer is it was referral-based. A potential client approached another client of mine and asked if their bookkeeper would be interested in cleaning up their books. I’m a QuickBooks Pro Advisor, so when I found out it was a completely different system, I thought, “Accounting systems, for the most part, have a lot of the same functionality. I can take this on.”

To be very honest, I essentially agreed to do it before I’d really had the chance to complete all the FreshBooks training that was available. At the time, I had a small panic attack, thinking, “Wow, what did I agree to? This is different than what I’m used to!” But then once I got into it, and with help from the excellent Support team and Laura [Senior Partner Program Specialist], I learned the system really quickly. Then it was off to the races and I was able to do my first cleanup job in FreshBooks. That’s how I just dove right in, got to know the system, and haven’t stopped since then.

After that initial referral, what was it that made you continue using FreshBooks?

Rebecca: I really like that it’s focused on the same type of person I enjoy working with—small business owners, solopreneurs, and creative individuals. It’s streamlined, and it’s easier for non-accountant business owners to use. I like that FreshBooks focuses on the most common functionalities for that type of business owner. We’ve got Time Tracking, Invoicing, and Projects, and that really relates to so much of that market space. I didn’t want to miss out on having that under my tool belt.

I really like that FreshBooks is focused on the same type of person I enjoy working with—small business owners, solopreneurs, and creative individuals.

How do you and your client Alexis work together in FreshBooks on a day-to-day basis?

Rebecca: Alexis is one of those business owners [who] doesn’t necessarily want to be involved with every single step. She spends her time in FreshBooks doing time tracking, and she [will] create invoices for some clients.

I do the bookkeeping: I’ll go into her FreshBooks account, review everything, and handle the transactions that come in. For invoicing, I’ll check in with Alexis to make sure we’re on the same page as far as the hours that we’re invoicing. I’ll go in and review the invoice—making sure that the mechanics, like payment terms or payment type, are as they should be.

We come together once a quarter, and we go over the reports. And that’s our process. It’s been many months in the making, and now it’s just second nature, and it’s been working well.

Do you notice a difference when you’re working with a client who’s more involved in their accounting and actually using the software?

Rebecca: I would say business owners who are more involved with their accounting systems have a better understanding of their finances and their cash flow. When they’re logging in, seeing what their bank balance is, and making decisions based off of that.

How does this collaborative approach in FreshBooks support you as an accountant?

Rebecca: I feel pretty strongly that financial planning and tax advice should be coming from someone who is licensed in that specific area. I am able to be that strategic partner that comes to the table and lets them know that this is what the reports are saying and how that applies for their vision for the business. It’s more of a strategic strategic partnership in their business.

The quarterly meetings I have with Alexis are more strategic, where I share all the reporting information from FreshBooks, and we talk about the bigger picture and goals she has for the business. This is my favorite meeting—where it’s not just about the numbers, it’s about where the business is for now and where her vision is headed.

Of course, like any small business owner, any time that she wants to go in, she can run her reports, and she has the assurance that things have been completed for previous periods.

Do you think that it’s reassuring for clients to work in FreshBooks with their accounting professionals?

Rebecca: I would say so, in the respect that it’s easy to delegate the correct access that somebody needs. As a business owner myself, I can imagine that it feels really secure to be able to dictate what somebody has access to or doesn’t have access to. I have some clients who prefer for me to really only have traditional accountant access. Whereas there are others who want me to be more involved and assist in all different areas. So I think that gives business owners a lot more comfort.

As a small business owner yourself, how do you bring that into serving other small business clients?

Rebecca: I’ve found that there’s a slight coaching aspect to what I do. There’s definitely been a lot of listening, and sometimes there is some reassurance from me as a small business owner that it’s a wild rollercoaster. They’re not alone, and I am supporting them—yes, as an accounting professional, but also just cheering them on.

I think for me, maybe the hardest part of being a small business owner is it’s just you. Being on my own, I have found a couple of communities—the FreshBooks Accounting Partner community being a great example—where you can connect with other small business owners and share the aches and pains and celebrate the successes. I feel like I come to the table with clients and understand not just the accounting but the hard decisions you make as a small business owner.