New & Improved in FreshBooks: Payments Page, Recurring Templates and More

March has been a month of change for everyone, including us at FreshBooks. Here’s what we’ve been working on.

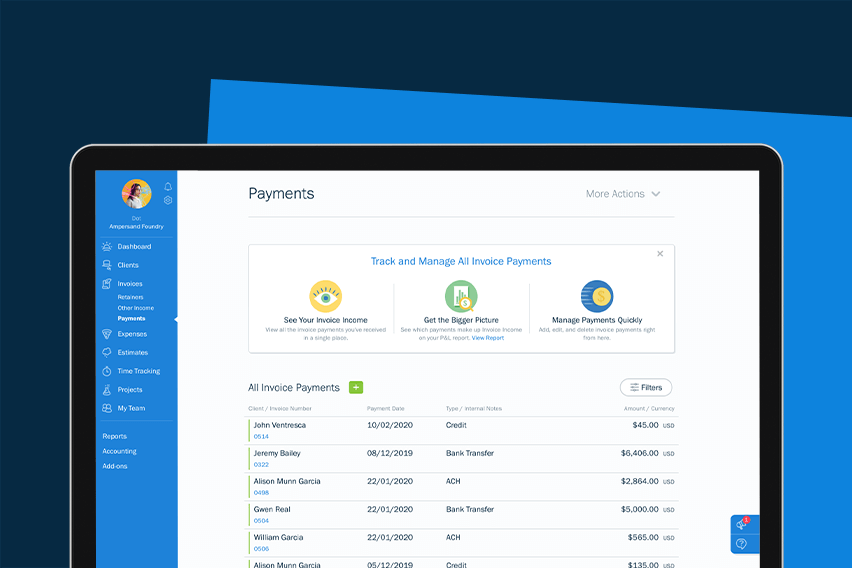

Manage All Your Invoice Payments in One Place

Clients today pay using a variety of methods: Checks, credit cards, bank transfers and even cash. And while knowing where exactly your money is coming from is important, it can sometimes be hard to keep track of it all. That’s why we designed the new Payments page. It will allow you to better manage all of your online and offline (manual) payments in one place.

You’ll have full control over tracking payments, and can easily:

- Add, edit or delete offline (manual) payments directly on the page

- Edit the Notes field for online payments

- Filter through payments by date, payment method, currency and client

- See which payments make up the income on your Profit & Loss Report

Quickly Turn Invoices Into Expenses

If you’re a small business that works with a lot of contractors, you can now easily convert invoices into expenses. This will allow you to quickly and accurately record contractor payments, as well as re-bill for that work without having to recreate the expense. Ready to give it a try? Check out our step-by-step guide here.

It’s Easier Than Ever to Create a Recurring Template

Do you use a lot of recurring templates, but sometimes find them hard to track down? We’ve added a Recurring Templates tab to your Invoices page for easier access. This tab will allow you to manage existing templates, as well as quickly add new ones using the green “+” sign next to the section header.

Search and Sort for Expenses

Having a bit of trouble tracking down a specific expense? You can now sort your search results by Date, Amount and Status to find the one you’re looking for faster.

Clients Can Now Conveniently Save Payment Info

Payments should be a simple, seamless process on FreshBooks. And to make them even easier for your clients, we’ve added the Bank on File feature. It allows your clients to securely store their bank information in FreshBooks, so that when they go to pay their next invoice it will be pre-filled and ready to go.

FreshBooks Is Here for You

We know that this has been a challenging month for small business owners. That’s why we’ve created a list of resources that we hope will help U.S., Canadian, UK, and Irish small businesses navigate these uncertain times.

And as always, our team is standing by to help your business in any way we can. So if you need a hand with anything else, please feel free to reach out.