New & Improved in FreshBooks: Redesigned Report Filters, Custom Invoice Emails and More

As small businesses continue to adjust to the “new normal” caused by COVID-19, the team at FreshBooks has been working on new releases. Here’s a look at the product updates from April.

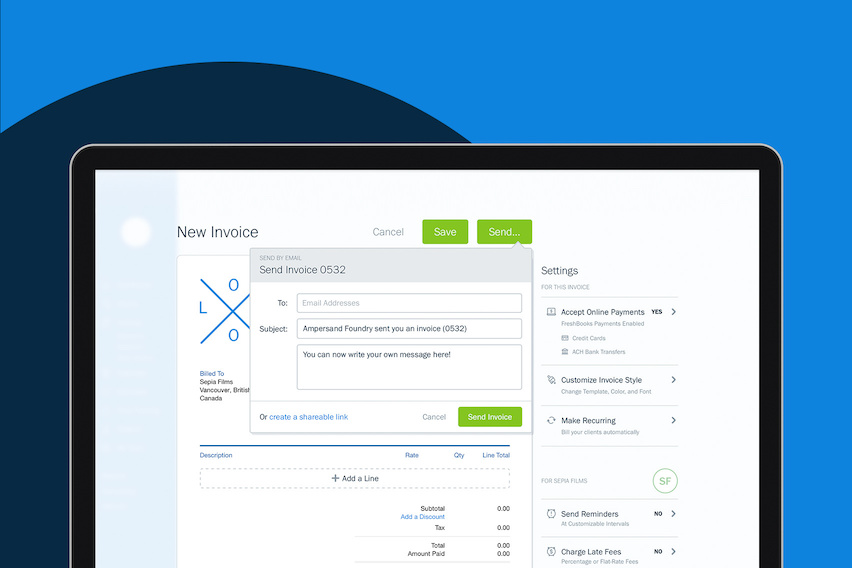

Customize the Email Attached to A New Invoice

Have you ever wanted to personalize the message attached to a new invoice? Now you can. After creating an invoice, you’ll have the option to write whatever message you would like instead of the pre-filled text. Here’s how it will look in your account:

Gain More Control Over Your Reports

You can now easily run reports with custom date ranges, client-specific filters, and statuses. So if you’re filing for SBA grants or relief funding, you can find the numbers the government needs in no time.

Plus, if you find yourself running the same specific report again and again, you can save the results as a bookmark in your browser. That way, the next time you need to run it, just launch the URL.

Shift Business Online with eCommerce Integrations

If you run a business looking to move sales online, FreshBooks can help you track the revenue with new integrations for Shopify, Squarespace, and more. Seamlessly keep track of every sale you make on each platform, and continue getting an accurate view of how much money you’re making in FreshBooks.

Easily Remove Duplicate Expenses

Have you ever imported expenses from a bank account, and noticed there are duplicate entries with expenses you’ve manually entered? Now, your Expenses page will display a banner showing you those potential duplicates, so you can easily review and remove them from your account.

Connect Your Gmail to FreshBooks

You can now add contacts as clients, and create and email FreshBooks invoices directly from your Gmail account. You can also see billing statuses for clients, so you know whether their invoices are overdue or outstanding. Check it out for yourself.

Expense Refunds Added to Reports

Refunds you receive for expenses are now reflected on both your Profit & Loss Report and your Expense Report. On your Profit & Loss Report you’ll see refunds deducted from the Total Expenses line, so you’ll know exactly how much money you’ve been reimbursed from a vendor.

Improved Accounts Aging Report

Want to see which invoices are outstanding or which clients still owe you money? Click on any number in your Accounts Aging Report to see which invoices are tied to it. No more need for complicated searches.

Quickly Find COVID Related Expenses

Easily track COVID-19 related expenses for government reimbursements or tax returns by adding “COVID” to an expense’s description. That way, you can quickly filter for those specific entries in the future.

FreshBooks Is Here for You

If you’re feeling isolated or worried about the survival of your business, just know that you’re not alone. That’s why we’ve created a list of resources that we hope will help U.S., Canadian, UK, and Irish small businesses navigate these uncertain times.

And as always, the FreshBooks team is standing by to answer any questions you have. So if you need a hand with anything else, please feel free to reach out.