Net terms and trade credit: Here's what all small business owners need to know.

Every single month, 60% of small businesses suffer from cash flow optimization challenges. Running a business is hard work to begin with. When money is scarce, it’s that much harder.

The prevalence of cash flow problems puts companies that provide small business clients with goods, materials, and other supplies in a difficult place. How can they grow their own businesses if many of their clients don’t have the cash needed to buy items from them?

Instead of only working with clients who have large amounts of cash on hand, many business owners offer businesses trade credit financing, providing them the services they need on net terms. Under these arrangements, clients get services today and are given a grace period (e.g., 30 days) before they’re expected to settle their accounts. This flexibility gives clients enough time to repay their vendors by the time payment is due.

How Do Net Terms Work?

When a business owner agrees to give their clients trade credit and offer net terms, they first need to determine when their clients should repay them. In most cases, business owners will give their clients 30, 60, or 90 days to pay, also known as giving net-30, net-60 or net-90 terms.

To encourage clients to pay invoices sooner, most business owners will offer early payment discounts. For example, giving a 2% discount to clients who settle their accounts within 10 days is quite common.

Most business owners know that some clients will take even longer to pay, no matter how generous the net terms. According to a recent analysis of over 20 million invoices, 64% of small businesses have to wait for late invoice payments. This in turn forces many small businesses, especially those that primarily transact with other small businesses (also known as SMB2Bs), to seek multiple other sources of business funding (including Fundbox) in order to keep operations going and growing.

To deal with this reality, most business owners offering net payment terms also charge interest fees on late payments.

Here’s an Example of Net Terms in Action:

- Let’s say a vendor gives two clients $3,000 worth of goods on net 60 terms with a 2% discount if they repay within 15 days (i.e., 2/15 n/60). The vendor tacks on a 6% interest fee each day a customer’s payment is late. Customer A takes advantage of the early payment discount, sending in a $2,940 check the following week. Customer B is 10 days late with their payment; with the interest that accrues, they owe $3,004.93.

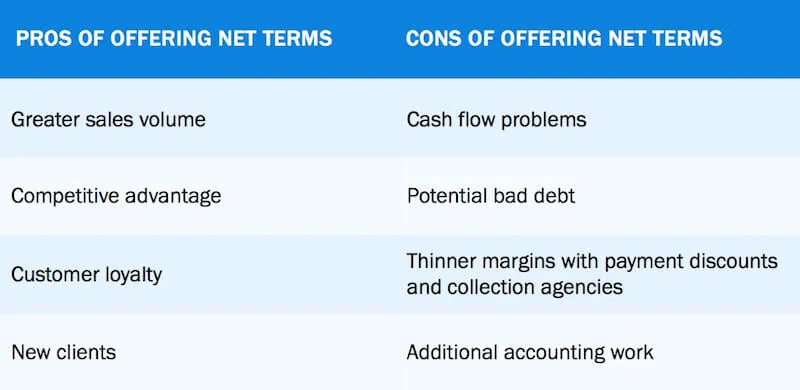

The Pros and Cons of Offering Net Terms

Generally speaking, business owners who offer net terms are able to drive more sales than those that do not because they’re able to sell to clients that have cash flow problems. In other words, they use trade credit to gain a competitive advantage over their peers who refuse to be as flexible.

Offering net terms can be a good way to build client relationships over time. In addition to repeatedly doing business with you, your most loyal, long-term clients are likely to recommend your company to the folks in their network who may need your supplies, giving you valuable word-of-mouth marketing.

Net terms, however, are not without their downsides. Not every client will be able to pay their invoices on time. This is the cause of many cash flow problems for B2B sellers. What’s more, some clients may not be able to repay you at all. Writing off a ton of bad debts can crush your bottom line.

Even when clients do pay quickly, there are some downsides. When clients take advantage of early payment discounts, your margins become thinner. The same holds true when you work with collection agencies to recoup late payments.

Finally, net term financing requires additional administrative work from your accounting department. You’ll have to keep track of which accounts owe what, when payments are due, which clients take advantage of early payment discounts, and which don’t pay on time.

How Net Terms Affect Your Cash Flow

Your cash flow can suffer severely when you offer net terms to your clients—even if they pay you on time. Much of your cash, after all, is tied up in the inventory you’ve fronted to your clients. Of course, the situation can become even bleaker when clients are late with their payments.

Businesses that still maintain their books by hand have it the worst because it’s harder to gauge their cash flow situation.

There’s a simple solution: Using cloud accounting tools FreshBooks can help accounting departments more easily determine where their cash flow stands at any given point in time.

Instead of offering net terms in the first place—and potentially encountering cash flow problems because of it—business owners can take advantage of some of the many convenient, online tools that have appeared in recent years to help manage payments. If you use a cloud-based accounting solution like FreshBooks, there are several strategies you can use to maximize cash flow. For example, you can accept online payments, which makes it easier for clients to pay right away. You can also automate late payment reminders and charge late payment fees if you choose.

Another online product, Fundbox Pay, was created specifically to help business owners get away from acting like banks by providing financing for their clients. Using Fundbox Pay, sellers get paid right away, and approved buyers get up to 60 days to pay their invoices, interest-free.

Trade credit can certainly help owners grow their businesses. However, as many vendors learn the hard way, it can also cause serious problems when many clients are unable to pay on time.

Sometimes, if you’re a B2B transacting with mostly smaller businesses, you might not have much choice when it comes to offering extended payment terms to your clients. The good news is that convenient, online payment tools are now available, allowing many small business owners to lay down the burden of playing “bank” for good.

Written by Irene Malatesta, Senior Content Marketing Manager and Editor

Posted on April 13, 2018