Learn all about your federal income tax obligations as an LLC business.

If you’re a business owner understanding how to file taxes for your limited liability company (LLC) is crucial for staying compliant with federal tax regulations and optimizing your tax strategy.

Filing LLC taxes may feel overwhelming at first and you’ve probably asked yourself things like, “What documents do I need to file my LLC taxes?”, but with the right guidance and answers it can be made much easier.

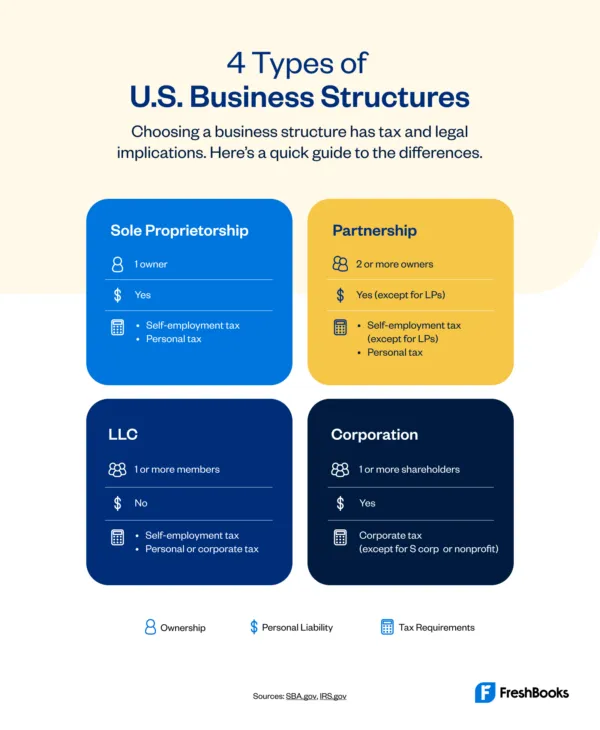

A limited liability company offers small business owners a valuable blend of liability protection and flexible tax treatment. Whether your LLC is treated as a sole proprietorship, partnership, or corporation for tax purposes, your federal income tax obligations will vary based on the LLC’s tax classification. You might need to file personal tax returns, pay self-employment taxes, or submit corporate income tax returns, depending on your chosen business structure.

In this guide, we’ll break down everything you need to know about filing taxes for your LLC. From understanding your LLC’s income tax treatment to identifying deductible business expenses, we’ll help you navigate federal taxes, estimated payments, and other tax considerations like state income taxes, franchise taxes, and sales taxes. Whether you’re filing as a single-member LLC, multi-member LLC, or electing S corporation status, this article will clarify the steps to ensure your LLC pays taxes accurately and efficiently.

Table of Contents

Default Tax Status

Filing taxes for your LLC? Here’s the catch: The IRS doesn’t recognize a limited liability company (LLC) as a separate tax entity. While you register your LLC at the state level, the IRS assigns your business a tax classification for federal tax purposes.

By default, the IRS will tax your LLC as either:

- A sole proprietorship, if there’s only one member.

- A partnership, if there are two or more members.

However, you can select a different tax treatment by filing specific IRS forms to have your LLC taxed as a corporation—either a C corporation or an S corporation. Let’s break down how each option works.

How to File as a Single-Member LLC

If you’re the sole owner of your LLC, the IRS will classify it as a disregarded entity for tax purposes (unless you choose otherwise). This means:

- The LLC’s income and expenses are reported on your personal tax return (Form 1040).

- You’ll need to complete Schedule C to report business income, deductible business expenses, and net income.

Key Points for Single-Member LLC Filing

- File Schedule C as part of your Form 1040.

- Include business income and losses directly on your individual income tax returns.

- If your LLC owns rental property, report income on Schedule E, not Schedule C.

- Taxes are due by April 15 (along with your personal tax return).

How to File as a Multi-Member LLC

For LLCs with more than one member, the IRS defaults to partnership tax treatment. Here’s what to expect:

- The LLC must file Form 1065 (Partnership Return of Income) annually.

- Each member receives a Schedule K-1, which details their share of the LLC’s profits, losses, deductions, and credits.

- Members report the information from their K-1 on Schedule E, attached to their Form 1040.

Key Points for Multi-Member LLC Filing

- Form 1065 and Schedule K-1 are due by March 15.

- Members report their share of LLC income on their personal tax returns, which are due by April 15.

How to File as a Corporation

LLCs can choose to be taxed as a C corporation or an S corporation by filing the appropriate IRS forms. This election doesn’t change the LLC’s business structure, only how it pays federal taxes.

Filing as a C Corporation

- Submit Form 8832 to elect C corporation tax treatment.

- File Form 1120 annually for corporate income taxes.

- The C corporation pays taxes on its income directly, which can lead to double taxation if profits are distributed to LLC members as dividends.

Filing as an S Corporation

- Submit Form 2553 to elect S corporation status.

- File Form 1120-S annually for the S corporation tax return.

- As a pass-through entity, the S corporation doesn’t pay taxes at the corporate level. Instead:

- Profits and losses flow through to members’ personal tax returns.

- Each LLC member receives a Schedule K-1 and reports the information on Schedule E with their Form 1040.

Key Considerations for Corporation Tax Status

- S corporations avoid double taxation but require strict compliance with IRS regulations.

- C corporations offer potential tax benefits at the corporate level but involve higher tax liability for distributed profits.

Estimated Quarterly Tax Payments

The U.S. tax system operates on a pay-as-you-go basis, meaning that LLC members or owners need to make tax payments throughout the year instead of waiting until April. For most LLCs, this means making estimated tax payments four times a year. These payments are especially important for covering income taxes and, in some cases, self-employment taxes.

Here’s what you need to know about estimated tax payments for LLCs:

- Due dates:

- For LLCs taxed as sole proprietorships, partnerships, or S corporations, estimated payments are due on April 15, June 15, September 15, and January 15 of the following year.

- LLCs taxed as C corporations follow a slightly different schedule, with payments due on April 15, June 15, September 15, and December 15 (or the 15th day of the 4th, 6th, 9th, and 12th months of their fiscal year).

- How to pay:

- Use Form 1040-ES for LLCs treated as sole proprietorships, partnerships, or S corporations.

- Use Form 1120-W for LLCs taxed as C corporations.

- Payments can be made online through IRS Direct Pay or the Electronic Federal Tax Payment System (EFTPS).

- Record-keeping: Keep a record of all payments, as you’ll need to report them when filing your LLC tax return.

Failing to make estimated payments on time may result in penalties, so staying on top of these deadlines is important to avoid these penalty fees.

Self-Employment Taxes

If your LLC’s income flows directly to you, the IRS considers it self-employment income, which means you’re responsible for paying self-employment taxes. These taxes cover Medicare and Social Security and amount to a total of 15.3%.

What to Know About Self-Employment Taxes for LLCs

- When it applies:

- LLC members taxed as a sole proprietorship or partnership are required to pay self-employment taxes on their share of business profits.

- If your LLC elects to be taxed as an S corporation or a C corporation, you won’t pay self-employment taxes directly; instead, these taxes are covered through payroll deductions.

- How to calculate: Use Schedule SE to calculate your self-employment tax liability. You’ll also report this amount when filing your personal tax returns (Form 1040).

- Deductions: The IRS allows you to deduct the employer portion of self-employment taxes, which can reduce your taxable income.

Understanding how to handle self-employment taxes is critical for managing your LLC tax liability effectively. Consider consulting a tax professional to ensure you’re taking full advantage of deductions and other tax benefits, especially if this is your first time filing.

State Income Taxes

While this guide focuses on federal income tax purposes, don’t forget that most LLCs are also subject to state income taxes. Each state has its own tax regulations, forms, and deadlines, so it’s crucial to check the specific requirements for your LLC.

Important Points About State Income Taxes for LLCs:

- State tax filing: You may need to file a state income tax return in addition to your federal taxes, depending on where your LLC operates.

- Annual filing fees: Some states charge annual filing fees or franchise taxes for LLCs, regardless of profits. For example:

- California: LLCs pay a minimum annual fee of $800, plus additional fees for business profits exceeding $250,000 (up to $11,790 for income above $5 million).

- Delaware: Requires an annual LLC tax of $300, even for inactive businesses.

- State-specific rules: Some states impose sales tax, franchise taxes, or other unique requirements for LLCs.

To avoid penalties or unnecessary costs, stay informed about your state’s tax laws and filing requirements. Working with a tax professional familiar with your state’s rules can help ensure compliance and streamline your LLC tax filing process.

Tax Return Due Dates

One of the most important aspects of filing taxes for a Limited Liability Company (LLC) is keeping track of the various due dates. Because LLCs can choose how they are taxed, the deadlines for filing tax forms vary depending on your tax classification. Missing a due date can lead to penalties, so staying on top of these deadlines is important.

Here’s a breakdown of due dates for different LLC tax classifications:

Single-Member LLC:

- Schedule C and Schedule SE are due April 15 (submitted with your personal tax return, Form 1040).

Multi-Member LLC:

- Form 1065 and Schedule K-1 are due March 15.

- Schedule SE and Schedule E (reporting your share of LLC income) are due April 15.

S Corporation:

- Form 1120-S and Schedule K-1 are due March 15.

C Corporation:

- Form 1120 is due April 15.

Note: These deadlines are based on businesses operating on a calendar year (ending December 31). If your LLC operates on a fiscal year, deadlines fall on the 15th day of the 3rd or 4th month after your fiscal year ends.

If you can’t meet the filing deadline, consider submitting an extension using IRS Form 4868 (for individual returns) or Form 7004 (for corporate tax returns). However, keep in mind that extensions only delay filing—not payment. Taxes owed must still be paid by the original due date to avoid penalties or interest.

Can an LLC Get a Tax Refund?

One common question for LLC owners is whether their business can receive a tax refund. The answer depends on your LLC’s tax classification.

- Pass-Through Entities (Single-Member LLC, Partnership, S Corporation): Since profits and losses pass through to the member’s personal income tax returns, refunds are issued to the individual—not the LLC. If you overpay, you’ll receive the refund as part of your personal tax return.

- C Corporations: Unlike pass-through entities, a C corporation files taxes separately and pays corporate income taxes directly. If a C corporation overpays its taxes, the IRS will issue a refund to the business itself.

In most cases, your LLC won’t directly receive a refund unless it’s taxed as a C corporation. However, keeping accurate records of your estimated tax payments can help ensure you avoid overpaying and maximize your refund if eligible.

Can I File My LLC Taxes Separately?

LLC owners often wonder if they can file taxes for their business separately from their personal income tax returns. Whether this is possible depends entirely on your LLC’s tax structure. Here’s a breakdown to help make it clear:

Single-Member LLC:

- The IRS treats single-member LLCs as a disregarded entity by default, meaning the business income is reported on your personal tax return (via Schedule C). You cannot file separately.

Multi-Member LLC:

- For LLCs taxed as partnerships, you must file a partnership tax return (Form 1065) for the business. However, the business profits and losses are still reported on the personal tax returns of each member via Schedule K-1.

S Corporation:

- Similar to partnerships, S corporations must file a corporate tax return (Form 1120-S) but pass profits and losses to members, who report this income on their personal tax returns.

C Corporation:

- LLCs taxed as C corporations file a corporate tax return (Form 1120) completely separate from their owners’ personal tax returns. Business income and expenses remain within the corporation, and owners only report their personal income (e.g., salaries or dividends) on their individual returns.

Understanding your LLC’s tax classification is crucial when determining whether you can file separately. If in doubt, consult a tax professional to ensure compliance with federal tax regulations and avoid costly mistakes.

Get Help With LLC Tax Filing

Filing taxes for your Limited Liability Company (LLC) can feel overwhelming, especially if you’re navigating federal income tax purposes or complex state tax regulations for the first time. Staying organized, keeping track of important deadlines, and knowing your LLC’s tax status can simplify the process.

Here are a few tips to make LLC tax filing easier:

- Organize your tax documents: Gather all required documents, such as income records, deductible business expenses, and any prior-year tax returns.

- Understand your tax structure: Know whether your LLC is taxed as a sole proprietorship, partnership, S corporation, or C corporation, as this determines the forms and deadlines you’ll need to follow.

- Use the right tax forms:

- Single-Member LLCs: Schedule C, Schedule SE, and Form 1040.

- Multi-Member LLCs: Form 1065 and Schedule K-1.

- S Corporations: Form 1120-S and Schedule K-1.

- C Corporations: Form 1120.

- Track estimated payments: Keep accurate records of quarterly estimated tax payments to avoid underpayment penalties.

- Consult a tax professional: If you’re unsure about any aspect of your LLC’s taxes, a tax professional can provide personalized advice and ensure compliance with federal tax regulations and state-specific requirements.

By understanding your LLC’s business structure, keeping accurate records, and seeking professional advice when needed, you can confidently file your taxes and focus on growing your business. Now that’s how you make tax time a lot easier.

This post was updated in December 2024.

Written by Erica Gellerman, Freelance Contributor

Posted on February 10, 2021

This article was verified by Janet Berry-Johnson, CPA and Freelance Contributor

Not Ready to File? How to Request a U.S. Tax Extension Based on Your Business Structure

Not Ready to File? How to Request a U.S. Tax Extension Based on Your Business Structure Keep These Tips in Mind When Filing Small Business Taxes for the First Time in the U.S.

Keep These Tips in Mind When Filing Small Business Taxes for the First Time in the U.S. Make Tax Time Easy: A Must-Read U.S. Small Business Tax Checklist

Make Tax Time Easy: A Must-Read U.S. Small Business Tax Checklist