Tax Advice

10 Tips for Super Last-Minute Tax Filers in the US

Even if you’ve procrastinated, there’s still time to prepare and file your tax return with these 10 tips for last-minute tax filers.

1. Get Your Financials in Order… Pronto!

If you’ve been diligently tracking income and expenses all year, you should be in good shape to file your tax return and get the best tax refund possible. All you need to do is print reports for your tax preparer. However, if you’ve neglected your monthly bookkeeping, it’s time to get your financials and tax documents in order.

Make sure you’ve recorded all revenue, entered all expenses, and kept copies of all receipts (either paper or electronic) in case your return is selected for an audit.

Whatever you do, don’t turn over a shoebox full of receipts and bank statements to your accountant. They’ll likely charge a higher hourly rate for the clean-up work in order to file your tax return. If you’ve maintained your financials every month, your tax preparer’s job will be easier (and cheaper).

2. Make Sure You Have All 1099s

If you’re a freelancer or independent contractor, make sure you have all 1099s you need from the clients and customers you worked for during the year. The government cross-checks the 1099s it receives on your behalf with the amount of income you report. If you underreport your income, you’ll hear from the Internal Revenue Service (IRS).

Keep in mind that businesses are not required to send you Form 1099 if you earned less than $600 during the year, but that income should still be reported on your tax return.

3. Secure the Biggest Allowable Deduction

Certain tax deductions (also called tax write-offs), like eligible business or personal expenses, lower your taxable income, which can potentially lower your tax bracket and reduce the amount of tax your pay. So, the more tax deductions you’re eligible for, the better! To take advantage of tax deductions, you’ll need to fill out and submit a Schedule C (Form 1040) along with your tax return.

For example, If you drive your personal vehicle for business, make sure you get the biggest allowable deduction to reduce your tax payment. Even if you owe money deductions can reduce how much you owe. The IRS gives you 2 choices:

- A standard deduction per mile the car was driven for business (worth 65.5 cents per mile for 2023)

- Actual expenses, including gas insurance, lease payments, and maintenance, multiplied by the percentage of business use

If you use the actual expense method in the first year you use your vehicle for business, you must use that method for the life of the vehicle. But if you use the standard mileage rate the first year, you can switch between that and the actual expense method each year. If you have a choice, calculate both methods and use whichever gives you a larger deduction.

4. Make Retroactive Retirement Plan Contributions

In many cases, you may be able to make deductible retirement plan contributions all the way up to the tax-filing deadline.

If you want to put away more money for retirement, you may be able to contribute to a SEP-IRA—a retirement account geared toward small business owners and the self-employed. If you apply for an extension of time to file your return, you have until the extended due date in October to make your deductible SEP-IRA contribution.

5. Contribute to a Health Savings Account

If you’re covered by a high-deductible health plan—defined as a minimum deductible of $1,500 for an individual or $3,000 for a family—you can also deduct contributions made to a Health Savings Account (HSA).

You have until the tax filing deadline to make a deductible contribution. For 2023, you can contribute up to $3,850 to an HSA if you have self-only coverage or $7,750 for family coverage. People aged 55 or older can make an additional $1,000 “catch-up” contribution.

6. Don’t Rush and Leave Room for Error

With the tax deadline looming, it’s tempting to rush through preparation for tax returns (or pressure your tax preparer to rush it for you), but that can be a costly mistake. Rushing often leads to missing deductions, typos, and math errors that may delay your tax return, cost you money, necessitate filing an amended tax return, or even increase the likelihood that your tax return will be selected for audit.

Carefully check your return, including the spelling of any names. Check Employer Identification Numbers (EIN) and Social Security numbers (SSN) to ensure you didn’t transpose any numbers. Double-check that all income and expenses are properly included. If you catch a mistake, you have time to correct it before filing.

7. Miss the Filing Deadline? File an Extension

If you just aren’t ready to file by the deadline, you can get an automatic extension (6-months). Electronically file your extension request for free using IRS Free File. If you owe tax, you can request your extension when you make a payment with IRS Direct Pay. Just choose Extension as your reason for payment.

You can also request an extension by mailing Form 4868 (Form 7004 for partnerships, some LLCs, and corporations). If you decide to mail your extension, be sure to mail the form and pay any estimated tax by the original tax deadline. It’s a good idea to send a certified return receipt, so you have proof of mailing.

8. You Still Have to Pay Taxes Owed

Keep in mind that an extension gives you extra time to file, not extra time to pay. You should estimate how much you owe and pay that amount by the due date, or face late payment penalties.

If you can’t come up with an accurate estimate of how much you owe, it’s a good idea to err on the side of overpaying. You can always have that overpayment refunded or applied to next year’s estimated taxes.

9. For Speed, Submit an E-File

The IRS encourages taxpayers to e-file returns because electronically submitted returns are generally more accurate. The software can help you avoid math mistakes, and the IRS e-file system flags common errors and kicks back returns for correction.

If you’re expecting a refund, e-filing with tax software can also help you get your refund faster, especially if you combine e-filing with having your refund direct deposited into your bank account. When you combine e-filing and direct deposit, the IRS says it processes 90% of refunds within 21 days.

10. Pay Your 1st Quarter Estimated Taxes

If you make quarterly estimated tax payments, now is also the time to make your 1st quarter estimate. The U.S. and most states have a pay-as-you-go system, meaning they require sole proprietors and pass-through businesses filing at the individual level who expect to owe $1,000 or more in taxes to make estimated quarterly payments. Quarterly estimates are also required of corporations expecting to owe $500 or more. If you wait until filing time to pay, you’re more likely to be charged penalties and interest.

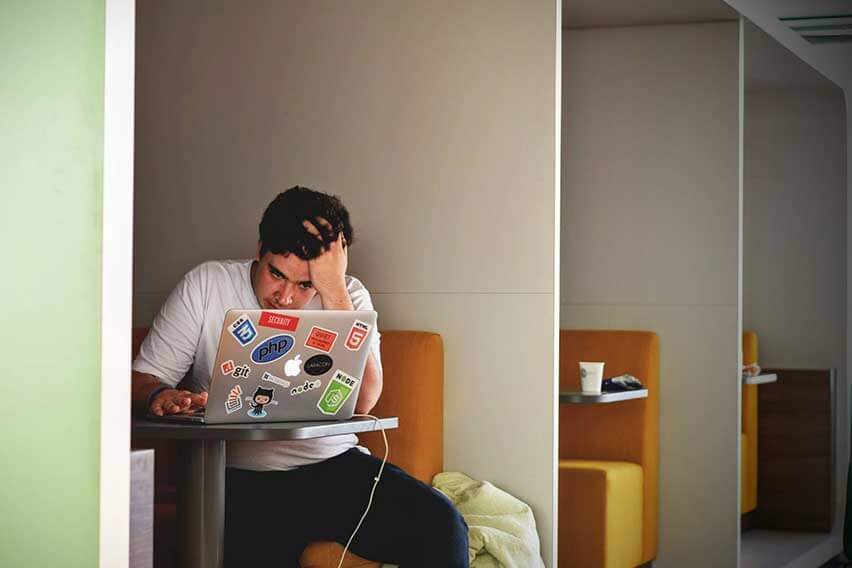

Last-Minute Tax Filers, Don’t Stress

The whirlwind of last-minute tax filing can be stressful but don’t get overwhelmed and waste time worrying instead of working.

Make a list of the documents (tax forms) you need to collect and the steps you need to complete your tax returns. Estimate how long it will take to complete each task. And remember, you can file an extension.

Just make sure you work on finalizing your return within the next few months, so you don’t find yourself in the same predicament every fall.

This post was updated in January 2024.