Say goodbye to manual payroll entries when you integrate Gusto with FreshBooks.

As your business grows, so does the number of people you work with. You might start out as a solo content creator, doing everything yourself. But as you take on more clients, you begin to add more team members—videographers, editors, freelance writers … the list goes on.

That’s great news! But with growth comes growing pains that can complicate your accounting. You now have several employees and contractors to pay, different kinds of taxes to calculate, and more entries to make in your books. On top of all that, you have to jump from your accounting platform to your payroll platform to make sure everything is accounted for.

Not anymore. Using the Gusto integration on FreshBooks, you can run your payroll and track every expense right from your account.

What Is Gusto?

Gusto is an all-in-one payroll platform that helps you onboard, pay, insure, and support your employees or contractors.

How Does Gusto Work With FreshBooks?

Once FreshBooks is connected with Gusto, your payroll transactions automatically sync to FreshBooks and appear as categorized expenses. Say goodbye to manual entries.

How Do I Connect My FreshBooks and Gusto Accounts?

To connect FreshBooks and Gusto:

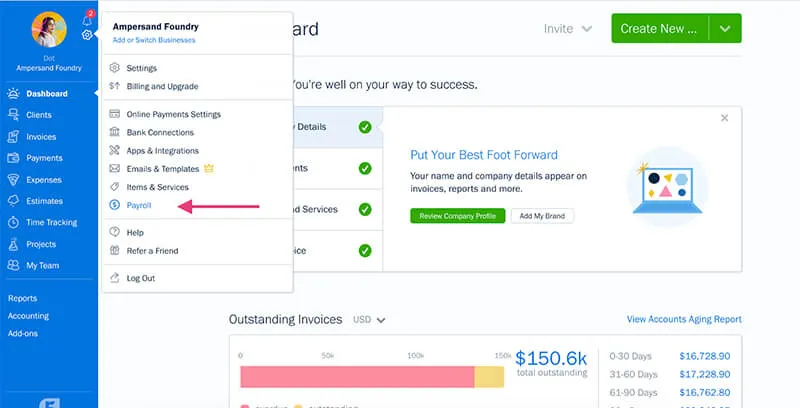

1. Navigate to the Payroll button from your Dashboard. Here’s what it looks like in-app:

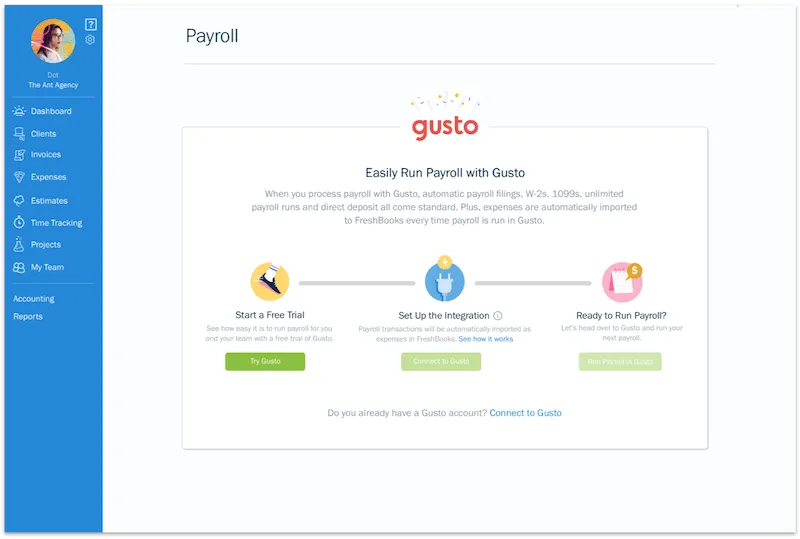

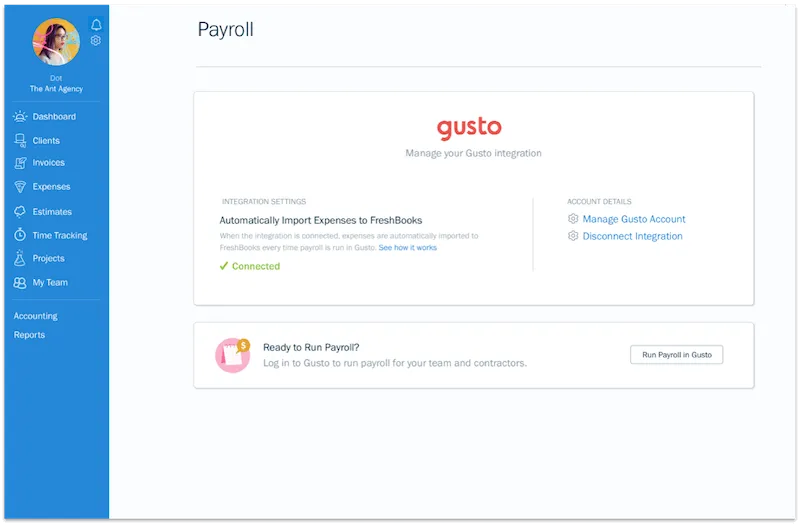

2. Connect your Gusto account and modify your integration settings:

3. Now, you can run payroll and review payroll expenses straight from your FreshBooks account.

What Else Can Gusto Do For Me?

Gusto can also help you:

- Set recurring pay schedules

- Automatically calculate, pay, and file local, state, and federal payroll taxes

- Allow your employees to onboard themselves, access pay stubs, W-2s, 1099s, and more

Need Help Getting Started?

You can find more information about Gusto integration on our FAQ page. If you want to speak with someone, a team of Support Rockstars is ready to help you out. Contact them here.

This post was updated in November 2023.

Written by FreshBooks

Posted on October 16, 2019

![U.S. Tax Checklist for Full-Time Business Owners [Free Download] cover image](https://prod-blog-k8s.freshenv.com/blog/wp-content/uploads/2023/01/freshbooks-136693-part2-taxtimechecklistassetsupdates-FullTime_Blog_Post_Image-226x150.jpg)

![How to Build a Winning Team for Your Growing Business [Free eBook] cover image](https://prod-blog-k8s.freshenv.com/blog/wp-content/uploads/2021/06/eBook_RAH_assets_Blog_Post_Image-226x150.jpg)