Save time by getting the tax-time information you need the first time.

Managing your workload during tax season can be a challenge. There is a lot of back and forth with clients, and they may not be quick to get you the documentation you need.

One thing that can make things run more smoothly is a thorough tax preparation checklist. This will help clients think through what they need to bring in or send. By spelling out exactly what you need, they can start collecting everything and getting it to you well in advance of the tax deadline. And they won’t come to you with a lot of missing pieces, requiring more time and work on your part.

Don’t reinvent the wheel. Create a tax checklist for your clients so they know what you need to get rolling on their taxes.

Table of Contents

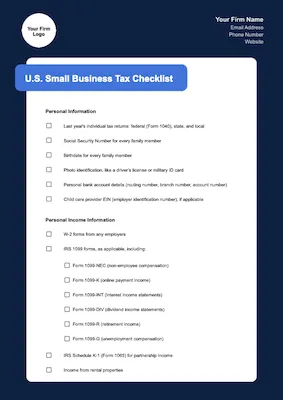

Client Tax Prep Checklist: What to Bring to Your Accountant

Every client’s list of requirements is going to be a little bit different. Some may have rental income from a property or business, and others might have employment income and need W-2 forms as well as their business income forms. Giving them a list of documents broken down into categories can help them think through what they need to bring to file their tax return.

The checklist covers 6 categories:

- Personal information

- Personal income

- Personal expenses

- Business information

- Business financial statements

- Business expenses

This article touches on the basics of each checklist category. For a more comprehensive version in a ready-to-share, customizable format, get the full checklist template.

1. Personal Information

Getting the personal identification details right on a tax return is important. Every year, the IRS rejects returns that don’t have matching data. To help get this right, ask your clients to bring:

- Prior year’s individual income tax return

- Social Security numbers for every family member

- Birthdate for every family member

- Photo identification

- Bank account details

- Child care provider EIN (employer identification number), if applicable

2. Personal Income Information

It’s important to help your clients understand that they need to be thorough when collecting income tax documents. Income documentation should cover all money that they received during the year.

You’ll want to have your client review the tax forms to make sure the amounts reported match their records. If there are any discrepancies, have them get those sorted out as early as possible.

Documents they should gather include:

- W-2 forms from any employers

- IRS 1099 forms, including:

- Form 1099-NEC (non-employee compensation)

- Form 1099-K (online payment income)

- Form 1099-INT (interest income statements)

- Form 1099-DIV (dividend income statements)

- Form 1099-R (retirement income)

- Form 1099-G (unemployment compensation)

- IRS Schedule K-1 (Form 1065) for partnership income

- Income from rental properties

3. Personal Expenses

Remind your clients that deductions and credits are where they can save big when it comes to their final bill. So it’s important for them to take the time to track down as many relevant expenses as possible.

Expenses they should be looking for include:

- Receipts for medical expenses

- Primary residence documents, including form 1098 (Mortgage Interest Statement), property tax records, and expenses related to energy-saving improvements

- Receipts for childcare expenses paid

- Charitable donation receipts

- Expenses related to any rental properties

4. Business Information

Owning and operating a business adds even more complexity to annual taxes. Business owners need to submit additional info to get started. Be sure to include these items on your checklist for business owners:

- Prior year’s corporate tax return

- EIN, if applicable

- Bank account details

- Partnership agreements, if applicable

- Change in ownership information, if applicable

5. Business Financial Statements

If your client owns their own business, you’ll want to remind them that they’ll need to provide you with financial statements. Ask them to provide:

- Profit and loss statement

- Balance sheet

If they use FreshBooks, remind them that these reports can be easily generated and shared with you. (They should invite you to one of the Accountant roles.) Before they hand over the reports, ask them to verify that the data is correct and complete. And if they have any questions, encourage them to flag them for you rather than to guess.

6. Business Expenses

Business financial statements aren’t going to be enough to complete your client’s business tax returns to file their business expenses and make sure that you help them find all the deductions possible.

Ask your clients to bring in additional business documentation and data, including:

- Vehicle use log: If they use their car for business use, remind them to keep a log and ask them to provide you with an up-to-date mileage log that details their travel.

- Home office details: If your client runs their business from home, ask them to bring in their home office details, including the size of their home office, rental payments, and utility bills.

- Asset purchase receipts: If your client purchased any capital assets during the year, ask them to bring in the receipts.

- Estimated tax payments made: If your client made any estimated payments to the IRS during the year, ask them to bring the records and receipts for payments made. If they didn’t make estimated payments, but they should have, you may want to have them set up due dates to make the 4 payments or work with you to calculate their estimated liability throughout the year.

Download the Complete Client Tax Checklist ⬇️

Looking for a ready-to-go checklist to share with your clients? Click these links for a handy tax checklist for your clients in Google Sheets or Google Docs formats to prepare them to file their tax returns.

The free, professionally designed checklist template can be customized with your firm’s logo and colors. And you can edit checklist items to suit the needs of your clients.

U.S. Small Business Tax Checklist [Google Docs]

U.S. Small Business Tax Checklist [Google Sheets]

How to Use the Checklist With Clients

Give clients the checklist and tell them to think through any items that they need to find and bring in. You can also advise them if they’re not sure if you need something, to share it with you anyway. You can make the final decision about what is needed and what isn’t, and they’ll feel good knowing that they’ve left no stone unturned in finding the necessary documentation.

As a tax preparer, getting your clients organized early on in the document retrieval process can be a big help in managing your workload during this busy time. This tax prep checklist can help you communicate to clients exactly what you need, improving your odds for a successful tax season.

Disclaimer: This checklist is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. FreshBooks assumes no liability for actions taken in reliance upon the information contained herein.

Get More Client Resources From FreshBooks Academy

👋 We’ve got more great templates and resources for you and your clients in the FreshBooks Academy—an e-learning platform for FreshBooks accounting partners.

Not a member yet? Learn more about joining our amazing Accounting Partner Program, which includes access to valuable client resources, training, and discounts for accounting professionals who serve small businesses.

This post was updated in February 2024.

Written by Laura Crean, Partner Program & Education Manager, FreshBooks

Posted on March 16, 2021

This article was verified by Brian Streig, CPA, Tax Director, Calhoun, Thomson + Matza, LLP

How Tallyfor Integrates with FreshBooks for Easier U.S. Tax Returns

How Tallyfor Integrates with FreshBooks for Easier U.S. Tax Returns 7 Stress Management Strategies for Accountants

7 Stress Management Strategies for Accountants Practical Busy Season Advice From Accounting Professionals

Practical Busy Season Advice From Accounting Professionals