The in-app Accountant role provides all the tools you need to work with your accountant more easily than ever.

If you work with a certified public accountant or bookkeeper, then you know how valuable they are at providing an expert second opinion. Have a concern about your taxes? Give them a call. Need help with financial reporting? They have your back. Auditing financial documents? They know what to do.

But working together can be difficult when you’re not on the same platform. Numbers can get lost in translation, and you can waste time sending information and reports back and forth when working on financial analysis.

To solve those problems, FreshBooks has created the Accountant role. This user role gives your accountant all the tools they need for financial reporting – so you can collaborate together effectively on FreshBooks.

And with FreshBooks Accountant Partner Program, your accountant or bookkeeper will have all the resources and workflows needed when handling accountant responsibilities, like auditing financial documents.

Together, with the support of FreshBooks, you can examine financial records, tackle accountant duties, look at financial reports, begin tax preparation, and more.

Table of Contents

What Is the Accountant Role?

The Accountant role gives an accounting professional access to the tools, reports, and information they need in FreshBooks to properly advise your businesses financial data.

This includes the ability to:

- Access accounting reports like General Ledger, Balance Sheet, and Profit and Loss

- Create and edit Journal Entries

- Manage Chart of Accounts

- Review and manage Invoices, Expenses, Payments, Other Income, and Bank Reconciliation

Not only will your accounting professional be able to generate reports, but they’ll also have access to all the numbers they need to help you grow your business, save time with taxes, and see how your business is performing when looking at financial data.

Therefore, making your certified management accountant duties that much easier.

How Do I Invite My Accountant to FreshBooks?

Inviting your management accountants or bookkeepers to FreshBooks is simple:

- Log in to your FreshBooks account

- Once on your Dashboard, click the Add Team Member button in the top right corner

- Enter their Name and Email Address

- Under Roles and Permissions, click the green Invite button

- Select the Role you’d like your team member to have – if needed, review all roles’ permissions here

- Add a personal message if needed, then click Send Invitation

- Your accounting professional will receive an email with instructions to log in

What Will My Accountant See When I Invite Them?

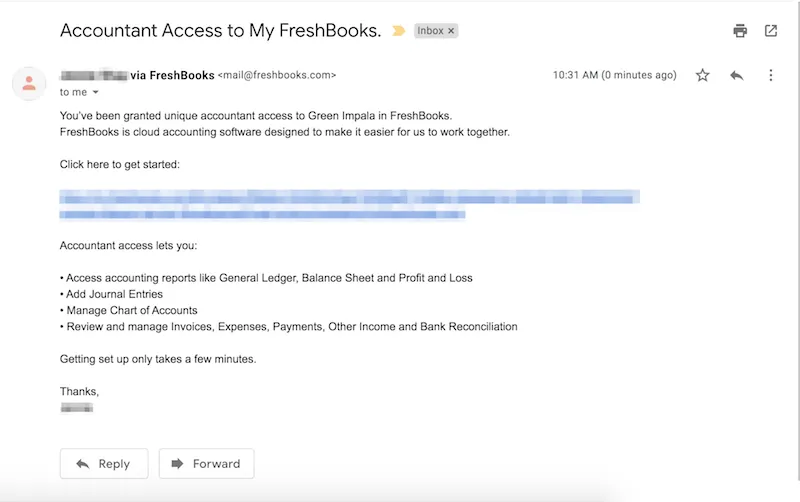

Your accountant or bookkeeper will receive a simple email from you, asking them to set up a FreshBooks account.

The email will look something like this:

Wait: Does My Accountant See Everything in My FreshBooks Account?

The Accountant role is not the same as your role as the Owner. Their permissions give them access to your:

- Dashboard

- Invoices and Other Income

- Expenses

- Reports

- Accounting (Chart of Accounts)

This allows them to access the financial data of your business in order to assess its financial position. These financial records are crucial for an accountants duties and responsibilities to your businesses overall financial health.

And, as you likely don’t have a degree in accounting, it makes sense that you would want someone act as your accounting department when handling your business transactions.

So, with all the accounting systems they have access to, you might be wondering what your accounting professional does not have access to?

Your accounts and bookkeepers cannot:

- Manage your Clients

- Track time or view your Projects

- Send invoices or estimates

- Manage Bank Connections

- Create recurring expenses or import a CSV file of expenses

Your accounting professionals will only have access to the information they need (like financial records) while protecting more sensitive areas of your business. (Learn more about these permissions here.)

Plus, if you use the FreshBooks Accountant Full Access option, you can allow your accounting professionals more access to financial records – something that might be helpful for tax preparation.

Click here to learn more about Team Member permissions with FreshBooks.

What Financial Statements Do They Focus On?

Financial information is the bread and butter for your accountants or bookkeepers. When using your FreshBooks Account, your financial advisors will act as your private accountants. They can focus on documents pertaining to financial statements, financial records, financial information, and, well you get the gist.

When preparing financial statements, understanding and keeping these financial records organized is extremely important.

Things to Keep in Mind

First things first, it’s not absolutely necessary to hire an accounting professional to help with your finances.

In fact, you may prefer to handle your books on your own rather than hiring a certified financial analyst, as it keeps you more connected to your business.

That’s totally up to you! You might have impressive accounting skills and a good understanding of financial regulations all on your own. And if that’s the case, we applaud you.

But, if it’s not the case, and you trust an accountant or bookkeeper to help you save time on your books, or just appreciate having an expert second opinion view your financial position, you’ll love how easy it is to work together on FreshBooks. And you can rest assured that your accountant or bookkeeper only has access to the areas of your business you want them to when reporting financial data.

Click here to invite your accountant today and get started.

This post was updated in October 2023.

Written by FreshBooks

Posted on July 9, 2020

This article was verified by Janet Berry-Johnson, CPA and Freelance Contributor